Our Home Improvement News Statements

Wiki Article

The Definitive Guide for Home Improvement News

Table of ContentsThe Ultimate Guide To Home Improvement News3 Simple Techniques For Home Improvement News7 Simple Techniques For Home Improvement NewsRumored Buzz on Home Improvement News

By making your residence extra safe, you can really make an earnings. The interior of your house can obtain dated if you don't make modifications as well as update it every when in a while. Interior decoration styles are constantly transforming as well as what was trendy 5 years back may look ludicrous now.You may also feel burnt out after taking a look at the same setting for many years, so some low-budget adjustments are constantly welcome to offer you a bit of change. You pick to integrate some classic components that will remain to appear current as well as stylish throughout time. Don't worry that these renovations will certainly be pricey.

Pro, Pointer Takeaway: If you feel that your residence is too little, you can remodel your basement to enhance the amount of room. You can use this as an extra space for your household or you can lease it out to generate added earnings. You can take advantage of it by working with experts who provide redesigning services.

Some Of Home Improvement News

Home remodellings can enhance the method your house looks, but the benefits are a lot more than that. Read on to learn the benefits of house restorations.

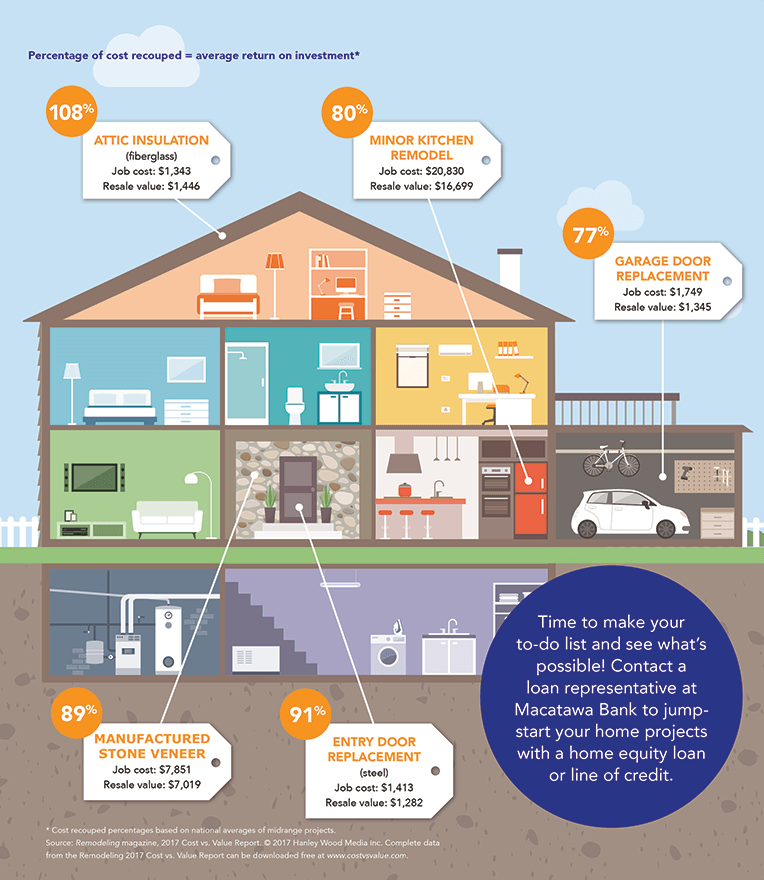

Not just will it look obsolete, yet locations of the home as well as important systems can begin to show wear. Routine house maintenance and repairs are essential to preserve your building worth. A house remodelling can aid you keep as well as increase that worth. Jobs like outside restorations, kitchen area renovations, and also washroom remodels all have excellent returns on financial investment.

Residence equity car loans are preferred among property owners wanting to money restorations at a reduced rates of interest than other funding options. One of the most common uses for residence equity. http://www.askmap.net/location/6640590/united-states/home-improvement-news funding are home renovation jobs as well as financial obligation consolidation. Making use of a home equity loan to make home improvements features a few advantages that other uses do not.

Fascination About Home Improvement News

That fixed rates of interest indicates your monthly repayment will certainly be constant over the regard to your car loan. In an increasing passion price environment, it may be less complicated to factor a fixed repayment right into your budget. The various other alternative when it comes to tapping your home's equity is a residence equity line of debt, or HELOC.Both house equity finances as well as HELOCs use your house as collateral to protect the car loan. If you can't afford your month-to-month payments, you can shed your house-- this is the most significant risk when borrowing with either kind of finance.

Take into consideration not simply what you want right now, however what will interest future purchasers since the projects you choose will certainly influence the resale value of your home. Deal with an accountant to make certain your interest is properly subtracted from your tax obligations, as it can save you tens of countless dollars over the life of the financing (commercial property management).

Some Ideas on Home Improvement News You Should Know

Home equity loans have low rates of interest compared to various other sorts of financings such as personal financings as well as bank card. Current house equity prices are as high as 8. 00%, but personal car loans go to 10. 81%, according to CNET's sister website Bankrate. With a residence equity funding, your rate of interest price will certainly be repaired, so you do not have to bother with it rising in a increasing rates of interest setting, such as the one we remain in today.As discussed above, it matters what type of improvement tasks you undertake, as certain home improvements provide a greater return on financial investment than others. A small cooking area remodel will certainly recover 86% of its worth when you market a residence contrasted with 52% for a timber deck enhancement, according to 2023 information from Redesigning publication that assesses the expense of renovating jobs.

While residential or commercial property values have increased over the last 2 years, if home prices go down for any type of reason in your location, your financial investment in enhancements will not have in fact enhanced your house's value. When you end up owing more on your mortgage than what your home is actually worth, it's called adverse equity or being "undersea" on your home loan.

With a fixed-interest price you don't require to stress regarding your payments going up or paying a lot more in interest over time. All of the cash money from the car loan is distributed to you upfront in one settlement, so you have accessibility to all of your funds instantly.

Report this wiki page